Urban communities which experience rapid growth at their edges often witness disinvestments in their urban core and first ring suburbs as these were abandoned for newer, lower-density, dispersed developments on the urban fringe. This pattern of development, which occurred after World War II, had dramatic effects on the social and economic viability of many core jurisdictions. It also led to significant impacts on the natural environment by developing on formerly open lands, which reduce animal habitats, degraded water resources and water quality, and influenced transportation choices that over time degraded air quality and increased the threat of global climate change. Communities are now questioning the economic and environmental rationale of abandoning neighborhoods, sidewalks, and water and sewer services in the urban center and older suburbs, only to rebuild them further out.

Sustainable growth directs developments towards communities already served by infrastructure, seeking to utilize the resources that existing neighborhoods offer and to maintain the value of public and private investment. By encouraging development in existing areas, communities benefit from a stronger tax base, closer proximity of jobs and services, increased efficiency of already developed land and space. In addition, the process of increasing development in existing communities can maximize the use of existing impervious surfaces, thereby improving local and regional water quality, and can create opportunities for more transportation options, which lower vehicle miles traveled and ultimately improve regional air quality. Often existing neighborhoods can accommodate much of the growth that communities require through infill development, brownfields redevelopment and the rehabilitation of existing buildings.

There are a number of barriers that discourage development in existing communities, some of which include detailed zoning plans, government policies and regulations, and taxpayer subsidies that encourage development in edge and Greenfield areas. Greenfield development remains attractive to developers for its ease of access and construction, lower land costs, and potential for larger parcel assembly. Typical zoning requirements in edge areas are often easier to comply with, because these areas often have few existing building types that new construction must complement and a relative absence of residents who may object to the inconvenience or disruption cause by new construction. Finally, the cost of Greenfield development is often subsidized by the public sector through the provision of road, sewer, and water networks, and through the use of average cost pricing, which can underestimate the true per-unit cost of expansion.

A range of options exists to begin to “level the playing field” between greenfield and infill development and to help direct new investment dollars to strengthen existing neighborhoods. Efforts to increase development in existing communities must be implemented with an eye to creating growth that improves the quality of life for existing residents as well as creates benefits for new investors. As more developers learn of the profitable experiences that their counterparts have had through infill development, the private market will increasingly identify ways to redirect resources to existing neighborhoods.

Why does directing development toward existing communities work?

- Being close to town is an amenity, ensuring shorter travel times o services and allowing for multiple modes of travel including walking and cycling

- Reduces infrastructure costs and improves the town’s economy and vibrancy

- Reduces costs for providing services such as fire, police and infrastructure maintenance

- Meaningful rural open space is protected

Why is strengthening and directing development toward existing communities needed?

- Directing development contributes to a more compact form of development which is less consumptive of land and resources. Many developers are bypassing vacant urban area land for less expensive land beyond our communities’ edges. Our current patterns of sprawling, low-density development at the urban fringe are consuming land (including farmlands, wetlands and other resource lands) at a much faster rate than the population growth.

- Directing development offers increased mobility for those who can’t drive or prefer not to drive. It is also an important part of the formula for minimizing traffic congestion. In-city living offers other transportation choices in addition to the automobile. Filling in the gaps creates higher average densities, which in turn support more frequent transit service. Residents who live near where they work, shop, or pursue other activities often can choose to walk, and carpools may be easier to arrange. Such choice is particularly important for those who can’t drive including elderly, youth, or low income residents who lack a car. Communities are learning that they cannot build their way out of traffic congestion. New highways or land additions typically fill up as fast as they are built as a result of the extended commutes and more frequent vehicle trips required by spread-out development. To the extent that people live closer to jobs, shopping and other activities, the number and length of vehicle trips can be reduced. Individual benefit from reduced transportation costs as well as increased time to pursue various interests.

- Fully utilizing existing facilities and service before considering costly service extensions to outlying areas offers saving for local government budgets. Building expensive new facilities while existing facilities have existing capacity is wasteful duplication in an era of belt tightening. Many local jurisdictions traditionally have averaged the costs of services across all users rather than charging the full cost of serving more distant development. This has mode outlying development relatively less expensive for the developer, while straining local government budgets. In addition, we are racing to construct new schools in outlying areas at the same time that we agonize over closing and finding new uses for inner city schools. Growth at the cities edges has come at the expense of central cities. Older buildings in core areas have been abandoned, existing utilities are underutilized and, in general, new investment has been redirected to the outlying areas. Directing development towards existing communities also bolsters local government budgets by putting underutilized vacant land back on the tax rolls. Spreading facility operation and maintenance costs among more residents and businesses ultimately will reduce costs for individual city taxpayers.

- Investment in our central cities is crucial to the overall economic health of the surrounding regions. Directing development toward existing communities brings increased numbers of residents to support in-city commercial centers. A more efficient business climate can result from employment centers located in close proximity rather than in scattered sites. The health of central city downtowns is intertwined with that of the region as a whole. For a region to be well-positioned to compete in a global economy, it must have at its vortex a thriving central city which can provide the vitality and draw to fuel the region’s economy.

- It can bring new opportunity and improved quality of life for in-city residents. The migration of higher-income residents, together with the best jobs, educational opportunities and services from many central cities, has left low-income residents isolated. It can be very difficult for them to learn about and travel to distant jobs, especially if dependent on transit that requires multiple bus transfers, or carpooling to scattered job sites. Reduce population and average income in cities also produces fewer tax dollars to support public services, and local businesses. Few opportunities and positive role models can contribute to loss of hope, increased anti-social behavior, crime and even riots. These trends further fuel middle-class migration from cities. In contrast, in-city neighborhoods offer living opportunities in neighborhoods with distinctive character and more opportunity for social interaction than sprawl development typically provides. Directing growth back to our current communities can return jobs, purchasing power and new amenities to our neighborhoods.

- In-city neighborhoods, which provide central gathering places within ready walking distance, can facilitate interaction between neighbors. Many existing in-city neighborhoods are load out with parks, elementary schools, and convenience shopping within walking distance. These neighborhood focal points provide opportunity for regular contact with neighbors. Furthermore, they already exist and need only be preserved. In addition, if people do not have to spend all of their time traveling in different directions to work, shop, go to school, and recreate, they will have more time for family or community affairs and activities.

Strengthening and redirecting development toward existing communities includes practices such as infill and brownfields redevelopment/revitalization. Infill development is the process of developing vacant or under-used land within existing urban areas that are already largely developed. Most communities have significant vacant land within city limits, which, for various reasons, has been passed over in the normal course of urbanization. A successful infill development program focuses on the completion of the existing community fabric. It focuses on filling gaps in existing neighborhoods. Infill development contributes to a healthy mix of uses that provides added vitality and convenience for residents. In addition, it is characterized by overall residential densities high enough to support transit, and a wider variety of services and amenities. It is designed to support improved transportation choices, including convenient vehicular and pedestrian circulation, and regular transit service. Attention to the character of development also is a key component for ensuring that the new development fits the existing context, and gains neighborhood acceptance. Infill development strives to address the needs of community growth by filling available spaces with urban centers before building in the undeveloped countryside. The underlying notion is to keep community resources –jobs, churches, schools, shops, restaurants, museums, and parks – where citizens are and vice versa.

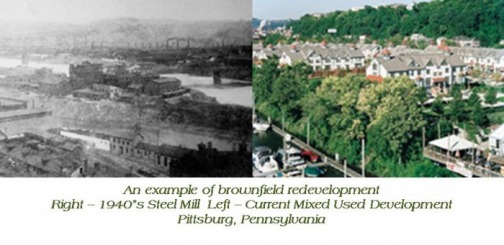

Brownfields are generally defined as abandoned or underused industrial or commercial properties where redevelopment is complicated by actual or perceived environmental contamination. Brownfields vary in size, location, age and past use; these spaces currently make up about five to ten percent of urban land in the United States. They can range from a small, abandoned corner gas station to a large, multi-acre former manufacturing plant that has been closed for years. With the redevelopment of brownfields, communities can reap real benefits. These benefits can include: a stronger tax base, closer proximity of jobs and services, taxpayers savings, reduced pressure to build on greenfield sites, and the preservation of farmland and open space.

Directing development to existing communities can also support cleaner air and water. When development occurs in existing places, it is easier to protect open space and natural lands and to minimize increases in impervious surfaces. This helps to protect watershed-wide water quality. Directing development can also create more transportation choices in existing places, which can lower vehicle miles traveled and ultimately improve regional air quality.

Some cities have suffered when residents move toward the suburbs and town centers become unoccupied. Sustainable growth addresses this problem by redirecting growth toward existing communities. Developing space in between cities and suburbs rather than greenfields combats the effect of sprawl. A large amount of savings can be seen thru the use of infill and brownfields redevelopment and revitalization while simultaneously reducing energy needs and dependence on crude oil.

A few options that will help strengthen and direct development toward existing communities includes:

- Business Improvement Districts (BIDs) direct fund to public services and businesses within the district, thereby fostering improvement for business. The local government levies fees from business within the district that are then used to supplement already provided public services.

- A Land Bank Authority (LBA) acquires abandoned lots and buildings, assumes the process of foreclosure and can easily transfer land to a private developer or the public market. Long neglected homes and businesses can be transferred to an LBA and provides more assurance to purchasers that the properties have a clean title.

- A Vacant Properties Coordinator can assess abandoned homes and buildings and create an inventory of homes to track information. Providing owners with information about rehabilitation grants and available resources facilitates rehabilitation among owners and community groups to improve these structures.

- An Asset-Driven Market Analysis examines location and local demand for services rather than just per-capita income for a more complete market analysis. Although a community may have a lower average household income, a need for services such as grocery stores and businesses creates an untapped market for growth within older neighborhoods.

- Use Priority Funding Areas (PFA) to direct development toward existing communities. The PFA approach is surprising simple. A governmental entity designates a geographic area as a “priority area” for receipt of infrastructure funding. This acts as an incentive to attract and retain market capital. While development is allowed outside of the PFAs, public resources do not subsidize it. This system has several advantages: localities consider and prioritize areas for future development and taxpayers benefit from more strategic use of public funds. These priorities send clear signals to the market as to where development will be supported, adding predictability to the development process. An increase on return on investment and a reduction in costs can also often be seen.

- Home equity assurance programs (HEAPs) have been used successfully in communities to curb the tide of middle-class flight, restore homeowner confidence in the local housing market, and revitalize transitional communities by both retaining homeowners and attracting new residents and businesses. A HEAP is a tool communities can use to reassure homeowners that their biggest asset – their home – will not lose value due to changing demographics, revitalization efforts, infill development, or construction or transportation infrastructure.

decline or targeted for additional development. Within those areas, existing

residential properties are insured against devaluation. The term of insurance is

limited to a reasonable time period (typically five (5) years) to allow changes or

new developments to fully integrate into the fabric of the neighborhood. A HEAP

can be financed with a variety of mechanisms, including bonds, general revenue,

special property-tax levies, or even a partnership with the private sector.

- A Development Finance Insurance (DFI) Program is one way to address the risk-return ratio without sacrificing extravagant amounts of public resources. A DFI program would operate on the same fundamental principles that form the basis of any system of risk insurance. A local government would establish a source of capital and use it to insure private lenders against the risk of loss associated with construction financing for projects designated as catalysts for community development. The key to the program is that a community’s DFI fund is not directly expended on the project itself. Rather, the local government works in partnership with designated private lenders and developers to form a financing package that comprises private capital to pay for the cost of project development. The local government uses the DFI fund as a form of escrow that lenders may draw upon in the event of default on a private construction loan.

A DFI program offers a number of important benefits. The most obvious advantage to such programs is that they conserve scare public funds while allowing communities to facilitate important development projects. Thus, were private lenders may balk at mixed-use development in older communities due to concerns generated from conventional lending practices, a DFI can bridge the gap between risk and return.

- A Revolving Loan Fund (RLF) is a capital fund designed to serve as a lender of last resort in high-risk transactions. The fund is initially capitalized out of a municipal/local government budget. Fund administrators us the RLF to provide financing to targeted community members at below-market interest rates and with tailored underwriting. The returns generated by payments plus interest on the initial loans “revolve” back into the lending pool for subsequent loans. Consequently, a properly manages RFL can continue to service a targeted population for a number of years without requiring additional capital form the community.

Sustainable growth directs development toward communities already served by infrastructure. The goal is to use resources that existing neighborhoods offer and to maintain the value of the public and private investment already made in those areas. Often, existing neighborhoods can accommodate much of the growth that communities require through infill development, brownfields redevelopment and the rehabilitation of existing buildings. The following tools are designed to address some of the issues and to provide ideas to strengthen and direct development toward existing communities.

Support community-based organizations involved in revitalizing neighborhoods

The cost of redeveloping land and buildings is not only driven by the cost of materials and labor, it is also influenced by the developer’s profit motive. In communities around the country, thousands of local community development corporations (CDCs) or other community-based organizations (CBOs) function as developers of residential and commercial property with not profit motive. As a result, these organizations are able to create viable, affordable projects, by using public, private and in-kind contributions, that would otherwise remain absent from the community’s building stock. These nonprofits have vast expertise in development at the neighborhood or block level. They are often capable of putting together complex financial development deals – involving as many as a dozen or more financial sources – that few profit-minded developers are willing to undertake.

Support for these community organizations in the form of financial resources, technical assistance, or time on the civic agenda of decision makers ensures that public resources are used for cost-efficient and civic-minded projects. This support improves the chances that public resources are used in projects that demonstrate a community’s own development priorities. CDCs and CBOs are often responsive and accountable to community members in a way that few other entities are. Board members and staff of these nonprofits often live in the neighborhood themselves, thereby ensuring that the activities that the organization seeks to complete help to achieve an improved quality of life for all residents of the neighborhood.

Create economic incentives for businesses and home owners to locate in areas with existing infrastructure

Public investment is often able to leverage private investment. In some cases, public investment may provide the necessary infrastructure to attract desired development. Additional economic incentives may be necessary, however, to help the business and development community focus its attention on a given, targeted neighborhood. This has been the experience with the successful models for zone and district development, such as business improvement districts, historic districts, Main Street Programs, and the federal government’s Empowerment Zone/Enterprise Community programs.

There are a wide range of economic incentives that can be made available to developers and property owners. For example, communities can offer favorable lending terms through dedicated bond issues; direct grants or loans through tax increment financing or from special assessments; tax abatements, credits or waivers; density bonuses or other zoning waivers; expedited permitting treatment; or outright grants of publicly-owned land or property. Often these economic incentives can be the missing source of gap or bridge financing that makes investment opportunities in existing neighborhoods viable. Finally, local employees can be enticed to live in existing communities near their place of work through “live near your work” initiatives.

Facilitate programs to encourage home renovation and rehabilitation in existing neighborhoods

Rehabilitation of existing homes represents a fundamental approach to strengthening existing neighborhoods. Communities, by creating tools and incentives for home owners to upgrade their own homes, can bring about visible new improvements in their neighborhoods. Such tools also allow residents to adapt their homes to changing needs and to remain in place as a long-term stabilizing force in the community. Furthermore, rehabilitation and renovation represent large and generally stable parts of the local economy, particularly doing slower economic periods.

Communities seeking to encourage home renovation and upgrading can provide grants, low-cost loans, tax abatements, or other incentives to home owners for rehabilitating their properties. Communities may also consider evaluating current building codes to ensure that they constitute a reasonable approach to ensuring safety in all building types.

Adopt a “fix-it-first” policy that sets priorities for upgrading existing facilities

Public expenditures on infrastructure, such as streets, highways, water and sewer systems, lighting, and schools and other civic buildings, constitute a significant share of public expenditures each year. Local and state governments suggest locational priorities for new development when governments allow infrastructure in existing neighborhoods to decay while investing in new infrastructure in edge communities. By not fixing this infrastructure, the local government creates for itself a larger fiscal problem for each year that the maintenance issues are not addressed. For example, a home owner spends time and money performing routine maintenance on a house in order to save money on costly repairs later and may expand or alter the house to better meet changing family needs. The maintenance and the expansion the home owner performs over time maximizes the value of the initial investment (i.e., the home) and is often less expensive than buying a new home. “Fix-it-first” policies apply the same rationale to public investments. They direct resources to support the maintenance and upgrading of existing structures and facilities. This helps to maintain the value of investments made by the private sector and to better position communities to attract private investment in new construction and rehabilitation.

Current state or federal funding formulas may make this difficult to implement, however. As with school construction, projects to repair existing assets that exceed a target level (some percentage of the cost of new construction) may be rejected in favor of new construction. States have, however, found the political will to overcome these barriers. New Jersey, for example, acted on the fix-it-first principle by requiring that maintenance needs on existing roads be addressed before new roads are constructed. Then- Governor Christine Todd Whitman committed $30 billion over 12 years for extensive repairs to the state’s highways and transit infrastructure, improvements in highway and pedestrian safety, and new rail initiatives to spur regional mobility. The rationale behind this initiative was the economic, social, and environmental costs of allowing current infrastructure to further degrade.

Locate civic buildings in existing communities rather than in greenfield areas

Public investment in civic building, including historic structures, can be a critical factor in the development of a community. The placement of public and civic buildings indicates the localities development priorities, and placement determines the residents’ accessibility to the government services that these buildings house. Furthermore, a range of private services, such as legal and advocacy services, benefit from close proximity to public buildings, such as courthouses and legislative chambers.

By locating public buildings (e.g., libraries, government buildings, and schools) in areas with existing infrastructure, state and local governments send a message to the rest of the community that these areas are worthwhile investment opportunities. Public buildings act as harbingers of revitalization in distressed communities where few employment opportunities exist or where a lack of services persists. Finally, they represent opportunities to go beyond merely maintaining the quality of public services in a community by adding services that were previously unavailable or inaccessible to local residents. The federal government recognizes the importance of the location of public-service buildings. In growing recognition of the important role that civic buildings play in the development of communities, federal legislation was introduced in the 107th Congress that placed a greater emphasis on the location of post office buildings in core downtown business districts.

Strengthen state or local brownfields programs

It is estimated that as many as 500,000 brownfields exist nationwide. Brownfields are those sites with real or perceived environmental contamination. In existing communities, brownfields represent untapped development opportunities and often act as impediments to community revitalization. Uncertainty about the extent of environmental damage, the cost of remediation, and the risk of liability for future owners often serve as obstacles to new investment for site owners, developers, and lenders and can further serve to drive new development to less problematic sites on the urban fringe.

Brownfields programs can help make these parcels available for redevelopment. In order to encourage brownfields redevelopment, nearly all states have developed legislation that limits and clarifies the liability of prospective purchasers, lenders, property owners, and others regarding their association with activities at a brownfields site. In addition, many communities have created state or local brownfields coordinator positions whose function is to coordinate information about sites, facilitate site assessments, market the sites to potential developers, and coordinate remediation efforts with the state environmental protection agency. In states and cities that already have established a brownfields program, these efforts can be strengthened to increase the effectiveness of existing programs, improve coordination with other players in the brownfields arena, improve remediation efforts, and better leverage support from high-level officials and executives to spur successful brownfields redevelopment.

Conduct an “infill checkup” to evaluate ad prioritize infill and brownfields sites for redevelopment

Infill locations pose a number of challenges to prospective developers that greenfield locations do not. Perceptions and realities about community opposition, environmental contamination, the difficulty of land assembly, access to the site, requirements for design conformity, and infrastructure service standards may discourage development that is needed to strengthen existing communities. Communities can attract infill investment by identifying priority sites for redevelopment—those that are likely to convey the greatest economic, environmental, or fiscal benefits—and then removing the obstacles that are preventing investment from taking place there.

Communities can be proactive in addressing these concerns by doing an “infill checkup” in which answers to the following critical questions are identified: Is the community ready to accept infill, and what are likely to be residents’ greatest concerns? Does the comprehensive plan (and applicable zoning code) include infill in its long-term vision, and do corollary public investments in infrastructure support it? Are efforts made to ensure that infill is constructed within the community’s character? Does the community have a transit system or are plans in place, and what are the implications for parking needs associated with new development? Is the community prepared to invest financially in infill where private investment alone is not enough to cover the costs of development? Does the zoning support, encourage, allow, or prohibit mixed-use, and what is needed for it to better support current needs? Finally, are design guidelines or project prototypes in place that clarify the community’s priorities for what development should look like? Answering these questions and implementing the needed changes to overcome any obstacles that appear as a result can ease the way for the redevelopment of critical infill and brownfields sites.

Encourage infill be adopting innovative stormwater regulations and practices

Development activities, both during construction and after a project has been built, are cited as factors that worsen the effects of stormwater runoff. Sediment from construction sites and debris and chemicals are carried to streams during heavy rainfalls. As more land in a watershed is built on, less rainfall soaks into the ground, increasing the amount of runoff that eventually makes its way to receiving waters.

While localities still invest in storm drains, stormwater sewer systems, and large containment areas, many also require developers to take measures with their projects to control stormwater. Stormwater retention ponds and infiltration areas are common practices that are written into local regulations. However, developers in urban areas are finding that requirements stipulating that stormwater be managed on the project site are a barrier to redevelopment and construction of infill and more compact projects. Land for onsite stormwater management is often not available or is prohibitively expensive. In addition, codes that limit the amount of impervious surface that can be built on a site discourage both development in urban areas and compact development. Inflexible stormwater regulations applied in urban areas can have the unintended effect of worsening water quality by forcing development to undeveloped fringe areas.

Fortunately, there are innovative options that foster redevelopment and control stormwater. In 2002, the city of San Diego adopted a policy of allowing infill redevelopers to share in the cost of stormwater abatement in lieu of onsite mitigation. Instead of requiring treatment of each individual project, the Standard Urban Stormwater Mitigation Plan allows developers to contribute to stormwater mitigation that serves the entire drainage basin. Engineers estimate that individual development projects can achieve savings of up to $40,000 by participating in a shared stormwater control program. The Low Impact Development Center, a nonprofit organization dedicated to protecting water resources through site-design techniques, is sponsoring research on low-impact development techniques that require less space. One technique is the use of soil amendments that allow compact landscaping to absorb and hold stormwater without causing flooding or damage to adjacent buildings.

Local jurisdictions are learning about different ways to satisfy stormwater and drainage issues associated with development and are exploring offsite mitigation possibilities. The possibility of

off-site mitigation makes smaller infill projects more feasible and provides an opportunity to locate mitigation facilities in a way that can serve multiple projects. In return for offsite mitigation, jurisdictions could increase allowable densities in downtown and designated areas. In such a case, the municipality would become accountable for maintaining water quality in that particular basin.

off-site mitigation makes smaller infill projects more feasible and provides an opportunity to locate mitigation facilities in a way that can serve multiple projects. In return for offsite mitigation, jurisdictions could increase allowable densities in downtown and designated areas. In such a case, the municipality would become accountable for maintaining water quality in that particular basin.

Increase transit-oriented development by adding infill stations on existing transit lines and retrofitting existing stations

Communities often overlook the potential of existing transit facilities to encourage additional development. Properly located and designed transit stations can boost surrounding property values

and encourage additional residential, retail, and commercial development. Adding or upgrading stations is a cost-effective way to encourage transit-oriented development. Because the transit

line already exists; the capital-intensive process of developing a new system can be bypassed. Adding or improving stations garners many of the same benefits for the community that a new transit system produces.

and encourage additional residential, retail, and commercial development. Adding or upgrading stations is a cost-effective way to encourage transit-oriented development. Because the transit

line already exists; the capital-intensive process of developing a new system can be bypassed. Adding or improving stations garners many of the same benefits for the community that a new transit system produces.

For example, officials in Washington, D.C., have already begun to capitalize on the city’s extensive Metro rail system to encourage additional development around many of the city’s stations. Along the system’s Red Line, officials are developing an additional Metro station at New York Avenue in the heart of downtown. The new station will connect local residents with downtown amenities and facilitate the growth of additional stores and businesses throughout the surrounding neighborhoods.

The promise of a new station has already begun to attract capital investment in the surrounding neighborhoods, boosting property values and encouraging new residential growth. A group of private property owners agreed to collectively pay $25 million (through a 30-year special property tax assessment) to build the station, and they are also donating the land to the Washington Metropolitan Area Transit Authority (WMATA). This money was supplemented with $31 million in federal funds and $34 million in city contributions. Public investment in the area includes $100 million in federal funds for the new national headquarters of the U.S. Bureau of Alcohol, Tobacco, Firearms and Explosives on vacant city-owned land adjacent to the Metro station. Officials believe that the goals to generate one billion dollars of public-private investment and 5,000 jobs by the time the Metro station opens in late 2004 will easily be surpassed. All of these considerable benefits will be achieved using an existing transit line.21

Develop asset-driven market analysis to encourage commercial and retail investment in underserved communities

Many communities, particularly those that have experienced population declines, have also lost commercial and retail investment, leaving markets underserved. This is largely the result of conventional market analyses that conclude that older communities with higher concentrations of moderate- to low-income households lack the buying power to support stores and businesses. These analyses often fail to take the population density of urban areas into account, focusing instead on average household income. In fact, retail is currently overbuilt in many suburban areas around the country and urban centers are an important untapped market. The urban market is underserved for everyday shopping needs and represents an opportunity for retailers. National retailers are beginning to make this realization and act accordingly.

Institute regional tax-base sharing to limit regional competition and to support schools and infrastructure throughout the region

The fiscal concerns of individual jurisdictions can create an intense local competition across regions which provide less housing development and more retail, entertainment, and hotel development. The revenues generated by the property tax on housing usually fail to cover the full costs of providing public services at all but the highest income levels. Conversely, retail and service development generates sales tax revenue that lands directly in local coffers because most state laws redirect tax proceeds to the jurisdiction where the sale takes place. The bidding wars that often ensue between jurisdictions lead them to offer a wide array of tax breaks and incentives for incoming businesses. When one community underwrites a new mall with costly incentives like undeveloped land, tax discounts, or road projects, other communities in the same region are forced to offer incentives of an equal scale to their malls in order to remain competitive. This type of regional competition can spur development at the edge, because in most cases, the new mall or retail outlet will use undeveloped lands, thus requiring new roads, infrastructure, and larger parcels for construction. In addition, this competition creates fiscal inequities between the communities that succeed in attracting businesses and those that do not or cannot.

Regional tax-base sharing allows the revenues collected (most often property tax assessments or sales tax revenues) to be distributed both to the locality where they were generated and to other

localities in the region based on their size, population, or other measures of disparity. Tax-base sharing recognizes that inter-jurisdictional competition for economic activity is, over time, a losing

proposition for all the governments involved. Tax-base sharing recognizes that both the causes and the benefits of growth tend be regional. The use of this tool can, for example, ensure that all area schools are working together to provide a well-trained workforce for the next wave of economic expansion. It also distributes the benefits of regional retail, for example, among the many localities that provide customers, thereby helping to generate tax revenues. This approach creates stronger resources across the entire region and can provide critical to strengthen existing communities that may suffer from disinvestment or stagnant economic growth. By minimizing regional competition for large commercial projects and business, such as malls and corporate headquarters, tax-base sharing can ensure that new development occurs where it makes the most sense, not for the sole purpose of raising the tax base of one jurisdiction.

localities in the region based on their size, population, or other measures of disparity. Tax-base sharing recognizes that inter-jurisdictional competition for economic activity is, over time, a losing

proposition for all the governments involved. Tax-base sharing recognizes that both the causes and the benefits of growth tend be regional. The use of this tool can, for example, ensure that all area schools are working together to provide a well-trained workforce for the next wave of economic expansion. It also distributes the benefits of regional retail, for example, among the many localities that provide customers, thereby helping to generate tax revenues. This approach creates stronger resources across the entire region and can provide critical to strengthen existing communities that may suffer from disinvestment or stagnant economic growth. By minimizing regional competition for large commercial projects and business, such as malls and corporate headquarters, tax-base sharing can ensure that new development occurs where it makes the most sense, not for the sole purpose of raising the tax base of one jurisdiction.

States have employed different approaches to this basic concept. In Minnesota, for example, business property taxes are shared among Minneapolis–St. Paul area governments, easing the fiscal crisis in the area’s declining communities. Tax-base sharing also relieves the pressure that growing communities feel to spread local debt costs through growth, and it erodes fiscal incentives that encourage low-density development. Texas also offers a variation on tax sharing in which districts with high-value business property are given five options to share resources. These include directly sharing their property tax revenues with other districts, or agreeing to send surplus revenues to the state for distribution to poor school districts. In Colorado, the neighboring towns of Windsor and Severance have agreed to share revenues from commercial activity along their shared Highway 392 corridor, thus saving each town from the cost and effort of attempts to draw businesses into its jurisdiction at the expense of its neighbor.

Use the split-rate property tax to encourage development on vacant or blighted pieces of land in existing communities

Property tax structures that assess land and improvements in the same way can act as an impediment to upgrading existing structures or adding buildings to currently vacant infill parcels. Owners may perceive the increased taxable basis on their property— and the tax liability that results—to exceed the economic value that could be derived from improving the property. As a result, vacant or underutilized land remains that way until the economics of potential improvements change, which encourages speculation. This is particularly problematic in areas suffering from disinvestment where the prospects for profitable investment by businesses are lower and where concentrations of underutilized property can exacerbate deterioration and neglect. The split-rate property tax shifts the balance of the tax burden onto land and away from improvements, which diminishes the tax consequences associated with making improvements on the land. It also raises the tax consequences associated with leaving vacant land dormant. Under a split-rate tax, there is more incentive for building owners to put their land to maximum productive use (within the constructs of building and zoning requirements). The split-rate tax thus stimulates development on lots that had previously acted as obstacles to redevelopment in existing neighborhoods.

Modify average cost-pricing practices in utilities to better account for costs of expanding infrastructure in greenfield areas

Low-density, dispersed developments generally enjoy subsidized utility costs because utility pricing is based on average—rather than actual—costs of providing services. Average cost pricing was established as a way to place rural residents on a level playing field with urban residents, but that policy is now contributing to rapid land consumption rates because the true costs of providing infrastructure to edge areas are often not passed on to either the developer or the final consumer. Cable television, electric, phone, water, gas, and wastewater services all charge for new hookups on an average-cost basis. A regional Bell telephone company, for example, estimated that, compared to the cost of serving customers in the central business district, it costs twice as much to serve households in the rest of the central city and ten times as much to serve households on the urban fringe. Because all customers pay average costs, residents in more urban, higher density areas in effect subsidize those in edge areas. Linear utilities such as cable television, water and sewer, phone service, and even mail delivery fail to reflect the efficiencies associated with clustered development.

Communities that have recognized this problem have had difficulty in arriving at a solution that is efficient and equitable. Assessing the true marginal cost of infrastructure expansion is difficult, since some capital investments (such as schools, treatment facilities, and pumping stations) cannot be expanded on a small, incremental basis. Rather, they require one-time large influxes of capital to expand the capacity for both current and future users. The city of San Diego, however, uses a different approach. It has created service areas designed for impact-fee financing, in which impact fees are lower for areas served by existing infrastructure and higher for those without. This “step” approach to calculating impact fees encourages development to occur in existing service areas by offering lower impact fees to the builders of new units. Conversely, higher fees (that more closely approximate the true cost) discourage development in unserviced areas.

A wide variety of resources and programs are available to help the San Joaquin Valley region expand its possibilities to strengthen and direct development toward existing communities. The following listing contains relevant programs, resources and contacts for technical assistance, financial tools and specialized expertise available locally, as well as at the state and national level.

§ List here (to be inserted at a later date)